| << Chapter < Page | Chapter >> Page > |

Monetary policy affects interest rates and the available quantity of loanable funds, which in turn affects several components of aggregate demand. Tight or contractionary monetary policy that leads to higher interest rates and a reduced quantity of loanable funds will reduce two components of aggregate demand. Business investment will decline because it is less attractive for firms to borrow money, and even firms that have money will notice that, with higher interest rates, it is relatively more attractive to put those funds in a financial investment than to make an investment in physical capital. In addition, higher interest rates will discourage consumer borrowing for big-ticket items like houses and cars. Conversely, loose or expansionary monetary policy that leads to lower interest rates and a higher quantity of loanable funds will tend to increase business investment and consumer borrowing for big-ticket items.

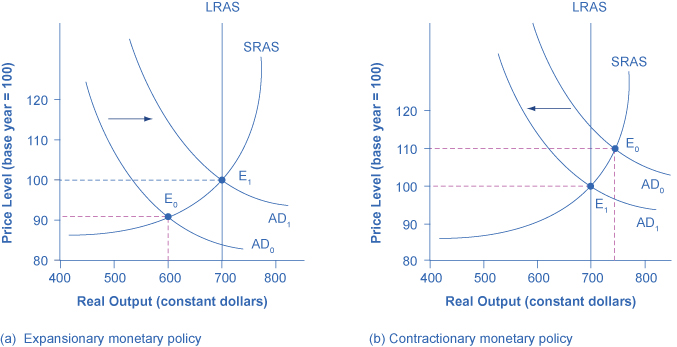

If the economy is suffering a recession and high unemployment, with output below potential GDP , expansionary monetary policy can help the economy return to potential GDP. [link] (a) illustrates this situation. This example uses a short-run upward-sloping Keynesian aggregate supply curve (SRAS). The original equilibrium during a recession of E 0 occurs at an output level of 600. An expansionary monetary policy will reduce interest rates and stimulate investment and consumption spending, causing the original aggregate demand curve (AD 0 ) to shift right to AD 1 , so that the new equilibrium (E 1 ) occurs at the potential GDP level of 700.

Conversely, if an economy is producing at a quantity of output above its potential GDP, a contractionary monetary policy can reduce the inflationary pressures for a rising price level. In [link] (b), the original equilibrium (E 0 ) occurs at an output of 750, which is above potential GDP. A contractionary monetary policy will raise interest rates, discourage borrowing for investment and consumption spending, and cause the original demand curve (AD 0 ) to shift left to AD 1 , so that the new equilibrium (E 1 ) occurs at the potential GDP level of 700.

These examples suggest that monetary policy should be countercyclical ; that is, it should act to counterbalance the business cycles of economic downturns and upswings. Monetary policy should be loosened when a recession has caused unemployment to increase and tightened when inflation threatens. Of course, countercyclical policy does pose a danger of overreaction. If loose monetary policy seeking to end a recession goes too far, it may push aggregate demand so far to the right that it triggers inflation. If tight monetary policy seeking to reduce inflation goes too far, it may push aggregate demand so far to the left that a recession begins. [link] (a) summarizes the chain of effects that connect loose and tight monetary policy to changes in output and the price level.

Notification Switch

Would you like to follow the 'Principles of macroeconomics for ap® courses' conversation and receive update notifications?