| << Chapter < Page | Chapter >> Page > |

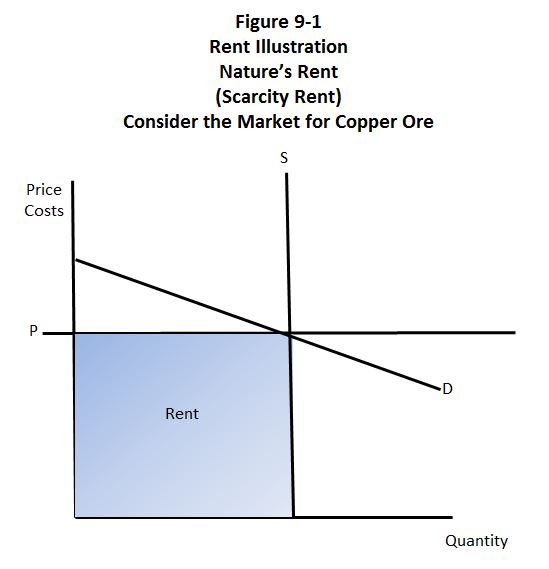

The concept of natural rent, or resource rent will be an important consideration when we discuss natural resources and sustainability.

But, over time, even natural resources such as copper or lithium are not in inelastic supply. Several things cause supply elasticity to increase over time, even for natural resources. What are they?

First higher prices- make old, abandoned deposits or previously inaccessible deposits profitable to exploit. Change in technology such as the, advent of horizontal drilling of oil and gas (to be discussed soon) makes many older or previously unattractive discoveries yield much higher returns.

Especially in oil and gas technological change which combined horizontal drilling with fracturing of sub-soils.

→ Much higher recovery from existing deposits.

So even with hydrocarbons and minerals, long run supply curves tend to flatten out toward the horizontal.

Also note, in many natural resource industries, rent is a mixture of monopoly or oligopoly rent and natural resource rent.

Consider the international copper industry. This is not a competitive, but an oligopolistic market.

Again: basically, a rent is any return in excess of the “normal” return to capital including Human Capital. We define “normal return” below. A rent may be very temporary , in which case we call it a quasi -rent. Rents may accrue to ownership in natural resources, in which case we call it a natural resource rent . (Note: rents should not be confused with risk premia). What are risk premia? Compensation to investors for accepting unusual risk.

All windfall gains are rents, but no t all rents are windfall gains . A windfall gain is an unanticipated rent . We will not very much concerned with windfall gains, as they tend to be transitory , and from economist’s point of view, tend to be counterbalanced by windfall losses . Good example of windfall gains: lottery winning.

Look again at definition of rent: any return in excess of the normal return to a factor of production, whether capital or labor or land.

Notification Switch

Would you like to follow the 'Economic development for the 21st century' conversation and receive update notifications?