| << Chapter < Page | Chapter >> Page > |

Capital formation essential for economic growth must be financed by savings from some source: public savings, foreign savings or domestic private savings. Mobilization of public savings requires a well-functioning tax system. We have seen, however, that a part of any increase in public sector savings gathered by government taxes will come at the expense of private savings: as much as 50%, according to some studies. Foreign savings (foreign investment and/or foreign aid) are difficult to mobilize on an ongoing basis. Most countries seeking economic growth must therefore place strong reliance on domestic private savings for financing domestic capital formation.

We first consider private household savings. Household savings includes savings in unincorporated enterprises (proprietorships, partnerships). In fact, small and medium sized private firms have been a substantial source of investment finance in many emerging nations. In the past few decades – these same enterprises typically provide the lion’s share of growth in jobs , as in the U.S., Germany and Korea 1960-1995. Worldwide smaller scale enterprises were responsible for 80% of employment in the three decades prior to 2010.

Consider the following taxonomy of domestic private savings (recall, saving is simply not consumption).

Private Savings in emerging nations consist mainly of categories #1, #5, #6 and #7, with some twists. In the past categories #2 and #3 in past (Bonds, Stocks) were not all that important in emerging nations because the organized financial system in emerging nations is not usually that well developed. However with growing capital mobility this is changing. Category #8 durable goods is interesting. In rich countries one rarely considers purchases of laptops as an act of savings. But it is non-consumption in any context? It generates future income, for many households (not all, of course).

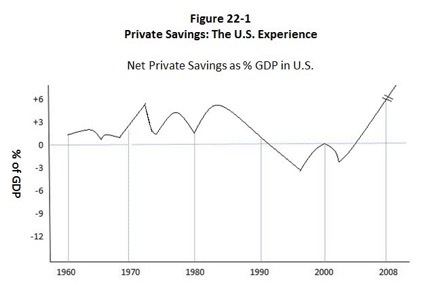

We first provide some perspective on private savings by examining the U.S. experience since 1960.

In some recent years net private savings was negative in the U.S.

| 2005 | -2.6% |

| 2006 | -3.8% |

| 2007 | -2.4% |

| 2008 | +1.6% |

| 2009 | +7.7% |

So now something very interesting happened to private savings in U.S. after 2007. 2007 was the very year the financial meltdown started, beginning the so-called “great recession”. In the U.S. in 2007, net private savings turned positive for the first time in fifteen years. Net private U.S. savings in 2007 were 1.6% of GDP. And in 2008, U.S. private savings, as % of GDP was 7.7%, and rose further by 2010.

Notification Switch

Would you like to follow the 'Economic development for the 21st century' conversation and receive update notifications?