| << Chapter < Page | Chapter >> Page > |

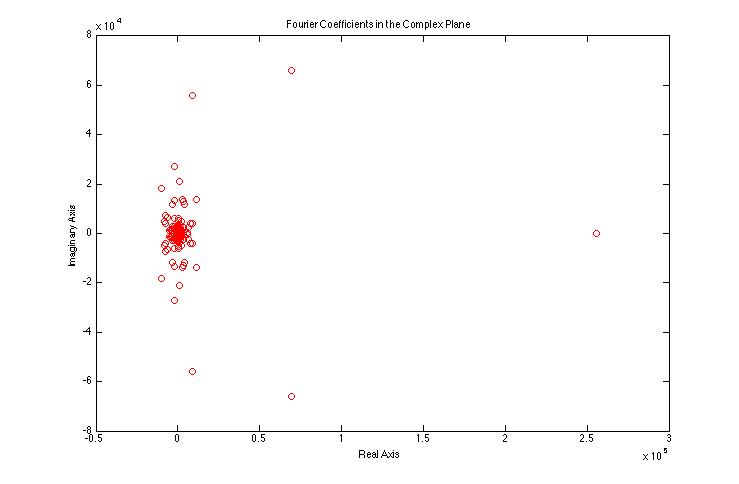

On further research, it became evident that in non-linear time series, linear analysis (i.e. traditional Fourier analysis) is not a valid approach. This is because simple Fourier analysis does not account for trends, drift, abrupt changes, and beginnings and ends of events, all of which are incredibly important parts of signals.

Notification Switch

Would you like to follow the 'Wavelet analysis of crude oil futures' conversation and receive update notifications?