| << Chapter < Page | Chapter >> Page > |

Considering Life Science as the “Leading” sector for nanotechnology applications, it could be asked why the apparent throughput of products remains low. It is worth stressing that due to the extensive development and rigorous regulatory pathways involved, this creates a particularly long time to market for innovations in the sector. In addition this is compounded by the need for framework to catch up with and effectively accommodate nanotechnology advances. It was highlighted by the US FDA in 2008 and again in 2009 that there was a lack of qualified people within the agency to be able to properly facilitate nano through approvals (ANH 2008, 2009)

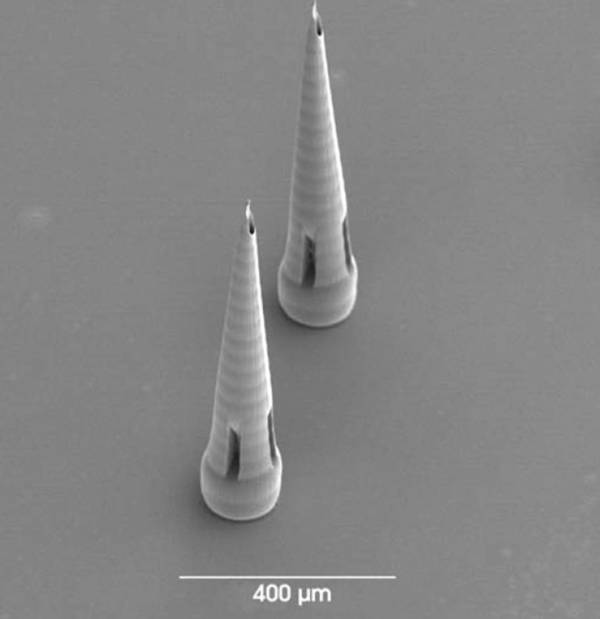

Within the combined sectors of Bio and Life Science exist numerous segments and markets which represent significant opportunities themselves. For example, the Medical Devices market is growing at ~9% each year presenting opportunities for nanotechnology applications. Meanwhile, other segments such as in-vitro diagnostics and medical imaging represent markets of ~$18 billion and ~$14 billion respectively (EPT 2005). It was highlighted by the Chairman of the Wellcome Trust, Sir William ('Bill') Castell in 2010 that “it is the low hanging fruit of diagnostics and imaging that will bring nano into forefront of healthcare” (Castell 2010). Within each of these sectors nanotechnology has the potential to be immensely disruptive. For example, within the field of drug delivery systems, a market worth ~$43 billion, there is significant potential for technologies such as Au (gold) particles (Cientifica 2008) and micro-needles (www.belasnet.be 2008), [link] and [link] , respectively.

The Southwest Wales Region has seen significant investment over recent years into its Knowledge Economy infrastructure. These investments have come from European Structural Funds, Welsh Assembly Government, academia, and the private sector. These initiatives include specific actions to support key growth sectors such as Life Science, Performance Engineering and ICT. Examples include:

Notification Switch

Would you like to follow the 'Nanomaterials and nanotechnology' conversation and receive update notifications?