| << Chapter < Page | Chapter >> Page > |

A glance back at economic history provides a second illustration of the power of automatic stabilizers. Remember that the length of economic upswings between recessions has become longer in the U.S. economy in recent decades (as discussed in Unemployment ). The three longest economic booms of the twentieth century happened in the 1960s, the 1980s, and the 1991–2001 time period. One reason why the economy has tipped into recession less frequently in recent decades is that the size of government spending and taxes has increased in the second half of the twentieth century. Thus, the automatic stabilizing effects from spending and taxes are now larger than they were in the first half of the twentieth century. Around 1900, for example, federal spending was only about 2% of GDP. In 1929, just before the Great Depression hit, government spending was still just 4% of GDP. In those earlier times, the smaller size of government made automatic stabilizers far less powerful than in the last few decades, when government spending often hovers at 20% of GDP or more.

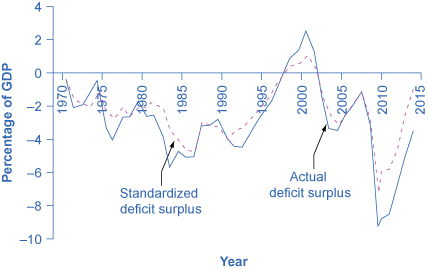

Each year, the nonpartisan Congressional Budget Office (CBO) calculates the standardized employment budget —that is, what the budget deficit or surplus would be if the economy were producing at potential GDP, where people who look for work were finding jobs in a reasonable period of time and businesses were making normal profits, with the result that both workers and businesses would be earning more and paying more taxes. In effect, the standardized employment deficit eliminates the impact of the automatic stabilizers. [link] compares the actual budget deficits of recent decades with the CBO’s standardized deficit.

Visit this website to learn more from the Congressional Budget Office.

Notice that in recession years, like the early 1990s, 2001, or 2009, the standardized employment deficit is smaller than the actual deficit. During recessions, the automatic stabilizers tend to increase the budget deficit, so if the economy was instead at full employment, the deficit would be reduced. However, in the late 1990s the standardized employment budget surplus was lower than the actual budget surplus. The gap between the standardized budget deficit or surplus and the actual budget deficit or surplus shows the impact of the automatic stabilizers. More generally, the standardized budget figures allow you to see what the budget deficit would look like with the economy held constant—at its potential GDP level of output.

Automatic stabilizers occur quickly. Lower wages means that a lower amount of taxes is withheld from paychecks right away. Higher unemployment or poverty means that government spending in those areas rises as quickly as people apply for benefits. However, while the automatic stabilizers offset part of the shifts in aggregate demand, they do not offset all or even most of it. Historically, automatic stabilizers on the tax and spending side offset about 10% of any initial movement in the level of output. This offset may not seem enormous, but it is still useful. Automatic stabilizers, like shock absorbers in a car, can be useful if they reduce the impact of the worst bumps, even if they do not eliminate the bumps altogether.

Fiscal policy is conducted both through discretionary fiscal policy, which occurs when the government enacts taxation or spending changes in response to economic events, or through automatic stabilizers, which are taxing and spending mechanisms that, by their design, shift in response to economic events without any further legislation. The standardized employment budget is the calculation of what the budget deficit or budget surplus would have been in a given year if the economy had been producing at its potential GDP in that year. Many economists and politicians criticize the use of fiscal policy for a variety of reasons, including concerns over time lags, the impact on interest rates, and the inherently political nature of fiscal policy. We cover the critique of fiscal policy in the next module.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?