| << Chapter < Page | Chapter >> Page > |

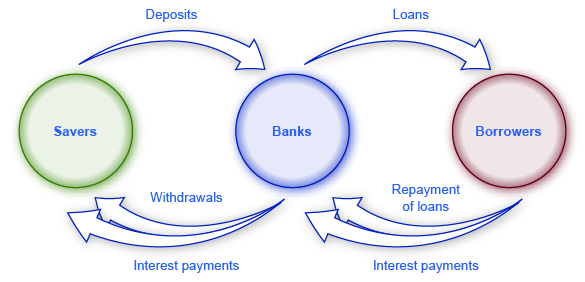

[link] illustrates the position of banks as a financial intermediary, with a pattern of deposits flowing into a bank and loans flowing out, and then repayment of the loans flowing back to the bank, with interest payments for the original savers.

Banks offer a range of accounts to serve different needs. A checking account typically pays little or no interest, but it facilitates transactions by giving you easy access to your money, either by writing a check or by using a debit card (that is, a card which works like a credit card, except that purchases are immediately deducted from your checking account rather than being billed separately through a credit card company). A savings account typically pays some interest rate, but getting the money typically requires you to make a trip to the bank or an automatic teller machine (or you can access the funds electronically). The lines between checking and savings accounts have blurred in the last couple of decades, as many banks offer checking accounts that will pay an interest rate similar to a savings account if you keep a certain minimum amount in the account, or conversely, offer savings accounts that allow you to write at least a few checks per month.

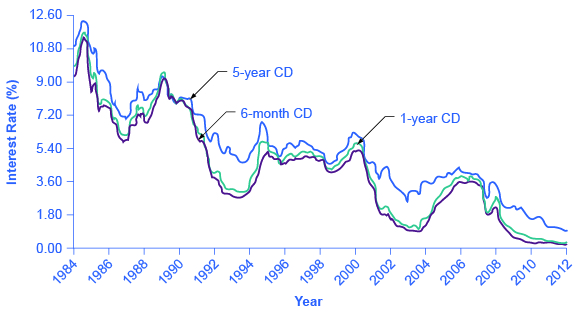

Another way to deposit savings at a bank is to use a certificate of deposit (CD) . With a CD, as it is commonly called, you agree to deposit a certain amount of money, often measured in thousands of dollars, in the account for a stated period of time, typically ranging from a few months to several years. In exchange, the bank agrees to pay a higher interest rate than for a regular savings account. While you can withdraw the money before the allotted time, as the advertisements for CDs always warn, there is “a substantial penalty for early withdrawal.”

[link] shows the annual rate of interest paid on a six-month, one-year, and five-year CD since 1984, as reported by Bankrate.com. The interest rates paid by savings accounts are typically a little lower than the CD rate, because financial investors need to receive a slightly higher rate of interest as compensation for promising to leave deposits untouched for a period of time in a CD, and thus giving up some liquidity.

The great advantages of bank accounts are that financial investors have very easy access to their money, and also money in bank accounts is extremely safe. In part, this safety arises because a bank account offers more security than keeping a few thousand dollars in the toe of a sock in your underwear drawer. In addition, the Federal Deposit Insurance Corporation (FDIC) protects the savings of the average person. Every bank is required by law to pay a fee to the FDIC, based on the size of its deposits. Then, if a bank should happen to go bankrupt and not be able to repay depositors, the FDIC guarantees that all customers will receive their deposits back up to $250,000.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?