| << Chapter < Page | Chapter >> Page > |

The key fact here is that the federal income tax is designed so that tax rates increase as income increases, up to a certain level. The payroll taxes that support Social Security and Medicare are designed in a different way. First, the payroll taxes for Social Security are imposed at a rate of 12.4% up to a certain wage limit, set at $118,500 in 2015. Medicare, on the other hand, pays for elderly healthcare, and is fixed at 2.9%, with no upper ceiling.

In both cases, the employer and the employee split the payroll taxes. An employee only sees 6.2% deducted from his paycheck for Social Security, and 1.45% from Medicare. However, as economists are quick to point out, the employer’s half of the taxes are probably passed along to the employees in the form of lower wages, so in reality, the worker pays all of the payroll taxes.

The Medicare payroll tax is also called a proportional tax ; that is, a flat percentage of all wages earned. The Social Security payroll tax is proportional up to the wage limit, but above that level it becomes a regressive tax , meaning that people with higher incomes pay a smaller share of their income in tax.

The third-largest source of federal tax revenue, as shown in [link] is the corporate income tax . The common name for corporate income is “profits.” Over time, corporate income tax receipts have declined as a share of GDP, from about 4% in the 1960s to an average of 1% to 2% of GDP in the first decade of the 2000s.

The federal government has a few other, smaller sources of revenue. It imposes an excise tax —that is, a tax on a particular good—on gasoline, tobacco, and alcohol. As a share of GDP, the amount collected by these taxes has stayed nearly constant over time, from about 2% of GDP in the 1960s to roughly 3% by 2014, according to the nonpartisan Congressional Budget Office. The government also imposes an estate and gift tax on people who pass large amounts of assets to the next generation—either after death or during life in the form of gifts. These estate and gift taxes collected about 0.2% of GDP in the first decade of the 2000s. By a quirk of legislation, the estate and gift tax was repealed in 2010, but reinstated in 2011. Other federal taxes, which are also relatively small in magnitude, include tariffs collected on imported goods and charges for inspections of goods entering the country.

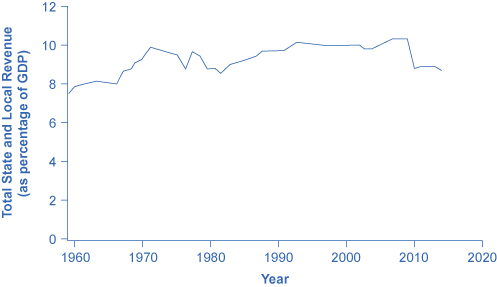

At the state and local level, taxes have been rising as a share of GDP over the last few decades to match the gradual rise in spending, as [link] illustrates. The main revenue sources for state and local governments are sales taxes, property taxes, and revenue passed along from the federal government, but many state and local governments also levy personal and corporate income taxes, as well as impose a wide variety of fees and charges. The specific sources of tax revenue vary widely across state and local governments. Some states rely more on property taxes, some on sales taxes, some on income taxes, and some more on revenues from the federal government.

The two main federal taxes are individual income taxes and payroll taxes that provide funds for Social Security and Medicare; these taxes together account for more than 80% of federal revenues. Other federal taxes include the corporate income tax, excise taxes on alcohol, gasoline and tobacco, and the estate and gift tax. A progressive tax is one, like the federal income tax, where those with higher incomes pay a higher share of taxes out of their income than those with lower incomes. A proportional tax is one, like the payroll tax for Medicare, where everyone pays the same share of taxes regardless of income level. A regressive tax is one, like the payroll tax (above a certain threshold) that supports Social Security, where those with high income pay a lower share of income in taxes than those with lower incomes.

Burman, Leonard E., and Joel Selmrod. Taxes in America: What Everyone Needs to Know . New York: Oxford University Press, 2012.

Hall, Robert E., and Alvin Rabushka. The Flat Tax (Hoover Classics) . Stanford: Hoover Institution Press, 2007.

Kliff, Sarah. “How Congress Paid for Obamacare (in Two Charts).” The Washington Post: WonkBlog (blog), August 30, 2012. http://www.washingtonpost.com/blogs/wonkblog/wp/2012/08/30/how-congress-paid-for-obamacare-in-two-charts/.

Matthews, Dylan. “America’s Taxes are the Most Progressive in the World. Its Government is Among the Least.” The Washington Post: WonkBlog (blog). April 5, 2013. http://www.washingtonpost.com/blogs/wonkblog/wp/2013/04/05/americas-taxes-are-the-most-progressive-in-the-world-its-government-is-among-the-least/.

Notification Switch

Would you like to follow the 'Principles of macroeconomics' conversation and receive update notifications?