| << Chapter < Page | Chapter >> Page > |

A bank makes it possible for two persons/businesses to do business in other ways than by transferring cash/money. There are various methods in which this can be done. The following are a few of these:

Talk to your educator and parents about what it means to cross a cheque. Why is it important to cross a cheque ?

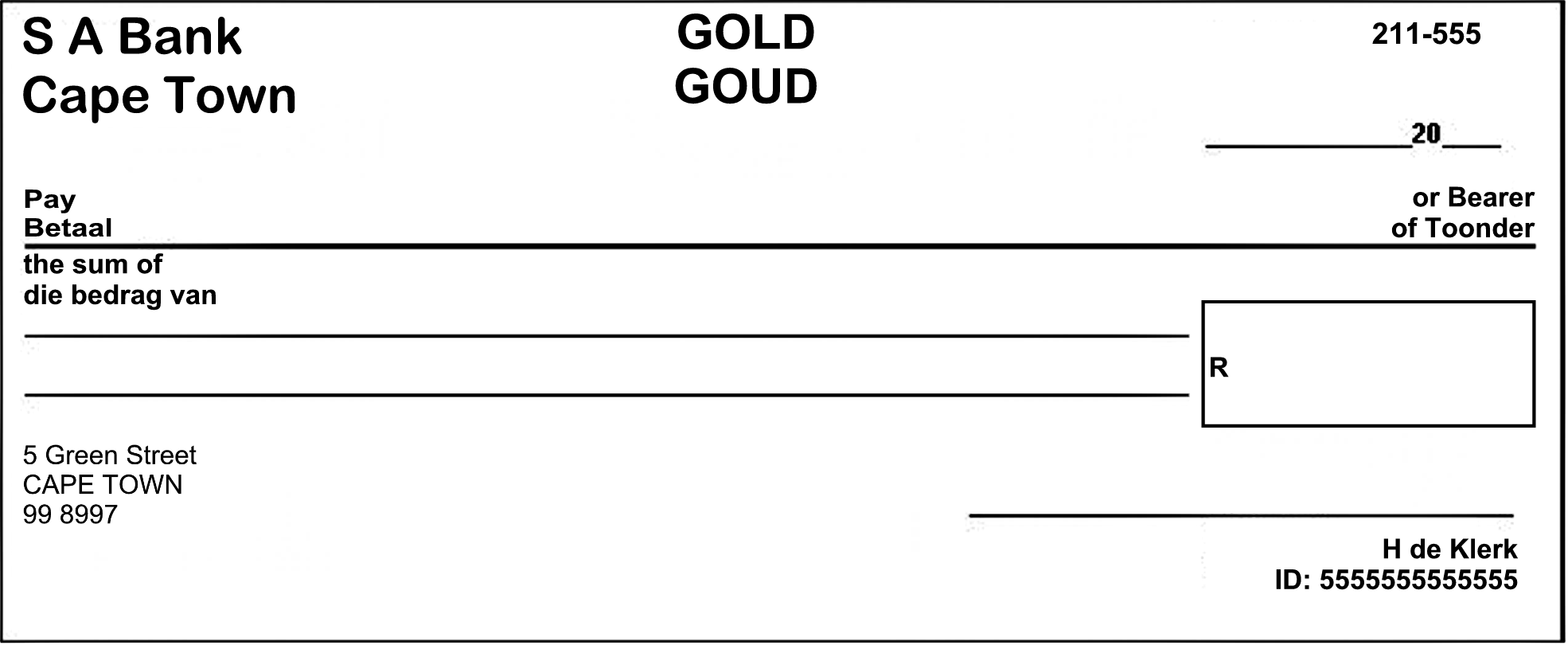

Now use these blank cheques to pay the following providers for services or products:

Star Supermarket for groceries to the value of R245,69;

Prima Park Primary School for school fees: R375,00.

[LO 3.3]

The claimant/service provider has a special machine that is able to read the magnetic strip on the card and register the transaction. The balance on the account of the person who is paying is automatically reduced by the relevant amount and the claimant’s or service provider’s account is increased by the same amount.

Example : If you have R500, 00 in your account and you purchase goods to the value of R120, 00 with your credit card, the following calculation will be done to provide your new balance:

R500,00 - R120,00 = R380,00

LO 3

Management, Consumer and Financial Knowledge and Skills

The learner is able to apply and demonstrate, in a responsible manner, knowledge as well as a range of management, consumer and financial skills.

We know this when the learner :

3.3 finds out and discusses how a savings account is opened at a bank, and completes deposit and withdrawal slips;

3.4 discusses the value of savings and thrift and people’s difficulty in saving if basic needs are not met.

Notification Switch

Would you like to follow the 'Economic and management sciences grade 5' conversation and receive update notifications?